Grant Management

Do you know that millions of euros of public subsidies go unallocated because nobody applies for them? At Euro-Funding we collaborate with companies and public

We are specialists in obtaining public funding for our clients’ innovative projects. We help companies and organisations to materialise their innovative projects by integrating the different financing tools that the different administrations make available to them.

In addition, we contribute to the development of the entire strategy of R&D&I projects, helping organisations to become more competitive and cutting-edge.

We have a network of consultants specialised in combining the different instruments for financing your innovative projects and advising you at all stages of your project. We offer neutrality, objectivity and transparency to your project and provide an objective and external assessment of the situation.

Remember that to be eligible for innovation funding you must have a company created, an innovative project and a budget of more than 175,000 euros.

More than 20 years of experience give us the ability to anticipate changes in the economic or regulatory situation and maximise the success of funding proposals.

At Euro-Funding we develop personalised and specific funding maps for each project through an exhaustive analysis of the different public calls for proposals at regional, state, European and international level. In addition, we analyse the possible tax incentives for R&D in order to obtain the highest return on investment.

If you have a company with a digitalisation project, productive industrial investment, R&D or the hiring of research personnel, you can apply for different types of aid in Spain and Europe.

Project financing is carried out through the publication of different public calls for proposals that establish a framework for project eligibility, establishing the technical, temporal and administrative characteristics that projects must meet in order to be financed.

Ensuring success in innovation project management

More than 20 years of experience give us the ability to anticipate changes in the economic or regulatory environment and maximise the success of funding proposals. At Euro-Funding we develop personalised and specific funding maps for each project through an exhaustive analysis of the different public calls for proposals at regional, state, European and international level. In addition, we analyse the possible tax incentives for R&D&I in order to obtain the highest return on investment.

If you have a company with a digitalisation project, productive industrial investment, R&D or the hiring of research personnel, you can apply for different types of aid in Spain and Europe.

There are economic aids that aim to finance companies and projects through credits and subsidies that the Administration grants through state institutions created specifically to finance their development.

The tax deductions associated with carrying out Research and Development (R&D) and Technological Innovation (TI) projects make it possible to reduce the payment of Corporate Tax by up to 57% of the expenses incurred.

Euro-Funding has been involved for more than 20 years in the analysis and identification of projects, the generation of technical-administrative support documentation and the accreditation of the R&D&I nature of the projects through external entities.

Under a success-based remuneration model, we collaborate with companies to achieve the maximum tax deduction. The different services we offer are the following:

Reduces 40% of the company’s social security contribution for common contingencies for personnel dedicated exclusively to R&D&I activities.

With a successful remuneration model, Euro-Funding has granted bonuses to more than 2.200 workers in the last three years.

We help our clients to recognise in the balance sheet certain expenses of their R&D projects in order to generate an intangible asset and thus improve the pre-tax result.

Reduces up to 60% of the income from the assignment or transfer of the right to use certain intangible assets.

We analyze the assets, the valuation of the expenses for their development, the determination of the income from the assignment and the quantification of the potential tax savings that could result.

The different instruments for financing innovation have specific requirements in terms of the characteristics of the projects as well as the specific mechanisms, applicable legislation and application deadlines.

Each project has its own characteristics, so in order to obtain funding it is essential to be clear about the different funding methods that exist, compatibility, application times, the time phase of the project and the characteristics and conditions to be met in each specific case.

Knowledge of each of the incentives is essential for the establishment of a roadmap to maximise the funding available for the development of an innovative project.

We have a team of experts who are able to analyse all the needs of your project and help you in all phases of it. Our expertise extends not only to large companies and industrial groups, but also to the entire business and knowledge generation sector, including SMEs, startups, technology centres, universities, etc.

We have a high capacity to adapt to new environments thanks to our regulatory knowledge, our relationship with administrations and our extensive network of partners and collaborators. 94% of our clients highlight the high specialisation of our technical team.

At Euro-Funding we provide you with financial solutions applied to your projects. Innovation projects can help your company achieve its objectives. The implementation of these projects acts as a way to generate substantial improvements in your bottom line.

It is necessary that the company believes in innovation as a tool for the success and development of its business, so we help you to make your project succeed. The aim is to generate new ideas that help your company to grow beyond its current competencies.

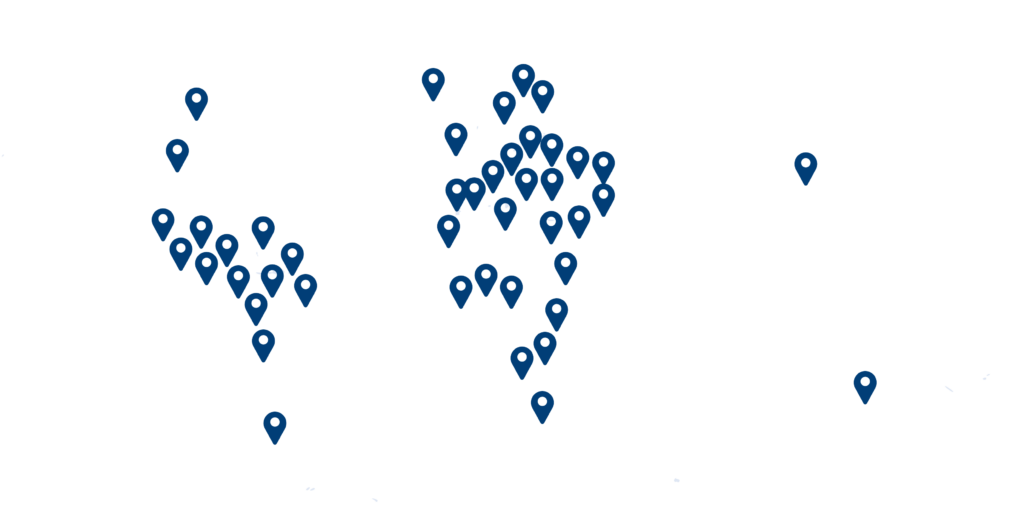

For more than two decades we have been forming an expert network that allows us to have a philosophy based on customer orientation, accompanying our clients wherever their projects may be.

Our commitment to collaboration extends to the widest range of projects that a company may have, from strategic projects that will mark the sustainability of the company in the coming years, as well as initiatives with a smaller budget but equally necessary to remain competitive.

We carry out continuous institutional work in collaboration with different state and autonomous community bodies, economic agents, sectoral associations, business schools and technology centres.

These alliances involve different joint actions such as the preparation of sectoral reports and the holding of conferences all over the world. Our 20 years of experience in the world of public funding has allowed us to maintain a close relationship with the Administration and the bodies that manage the different public funds.

Integrated Management System (Quality Management System ISO 9.001, Environmental Management System ISO 14.001, Energy Management System ISO 50.001 Information Security Management System 27.001).

We are subscribed to the United Nations Global Compact in the areas of human rights, labour, environmental protection and anti-corruption, complying with the ten Principles of the Compact, as established in its Code of Ethical Conduct.

We have been calculating and registering our Carbon Footprint in the Registry of the current Ministry for Ecological Transition and Demographic Challenge since 2014, maintaining a constant reduction of emissions.

Seal awarded by the Generalitat de Catalunya through ACCIÓ in which we are accredited as advisors. It serves to identify professionals with the most suitable profile to offer personalised and expert support to companies through the programmes offered by ACCIÓ.

More than 20 years in project finance. Around 46,500 projects managed and more than 5,940 million euros of financing and savings obtained for our clients.

More than 200 engineers with training in the financial field form the Euro-Funding team spread throughout our offices in A Coruña, Barcelona, Bilbao, Madrid, Seville and Valencia.

Do you know that millions of euros of public subsidies go unallocated because nobody applies for them? At Euro-Funding we collaborate with companies and public

We are experts in tax consultancy for large companies. We provide solutions in tax matters. Know your tax saving possibilities Ampliar información R&D tax deductions

The current context encourages companies to think about sustainability and the environment and to combine these concepts in their income statement. At Euro-Funding we accompany

Euro-Funding Multilateral Projects is the business unit specialised in the management of international cooperation projects within the framework of development cooperation programmes financed by multilateral organisations